Share Code: JSE: SNV – Market Cap: R900m – PE: 6.7x – DY: 2.5%

Business Overview: Global Track Record

- Listed on the JSE, Santova is a global technology-based trade solutions specialist providing innovative international end-to-end supply chain solutions. The Group operates primarily as a Fourth-Party Logistics (“4PL”) provider from 33 offices in 13 countries (& growing), whereby the Group manages the (increasingly) complex logistical needs of clients globally.

- The Group has grown organically and through 13 business acquisitions, with the quality of their acquisitive execution evidenced by the fact that only two of these acquisitions resulted in quite minor goodwill impairments.

- Related to this point and, more recently, in May 2025, the Group acquired Seabourne (England, France, Scotland and Netherlands), which should see the Group double revenue in FY 27E (the first year of full consolidation).

Key Upsides & Downsides: A Longer-term View Smooths the Volatility

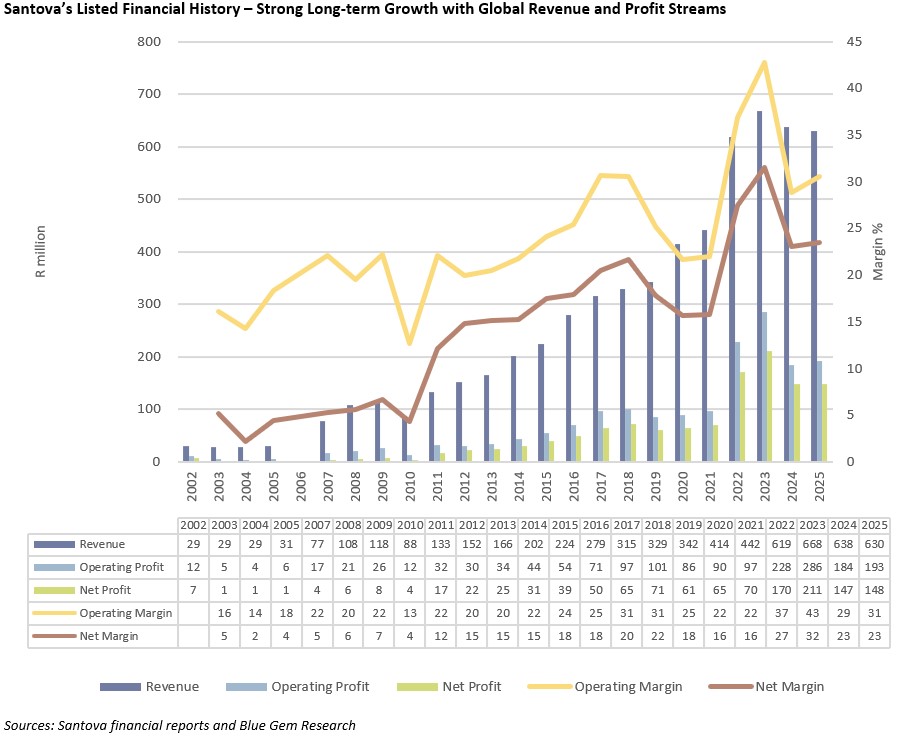

- In the short-term, Santova’s regional revenues and profits can be volatile from period to period (via volumes, freight rates and/or foreign exchange). However—when we look beyond short-term volatility—Santova has a strong track record of increasing earnings over the long term. Thus, we believe that the Group’s performance is best evaluated over five- or ten-year periods, smoothing potentially misleading short-term volatility.

- A shareholder would have achieved a c.10% p.a. CAGR Total Return (TR) over the decade to FY 25. However, we believe the share price is currently undervalued, which deflates TR. Furthermore, we believe that the current share price does not reflect the potential of Seabourne, and there is substantial upside from the current price (10-year TR < Next 10-year TR).

- Seabourne’s delivery on its profit warranty and exchange rates are likely to be the largest determinants of profits in the short- to medium-term.

Forecast, Valuation and Implied Return: Share Undervalued

- Our Group forecast is built from forecasting Santova and Seabourne, respectively, using historic margins, and assuming a conservative 3% real growth rate along with some other simplifying assumptions (flat FX).

- Using a DCF, we arrive at an implied fair value of R9.70, implying c.28% upside to the share price of R6.95. When considering global peers’ valuations and M&A multiples of the past two years, we believe there to be >60% potential upside which could crystallise in a range of ways over time.