Share Code: SBP – Market Cap: R3.6bn – Share Price discount to NAV: 31%

H1:25 Results: Share buy-backs enhance growth

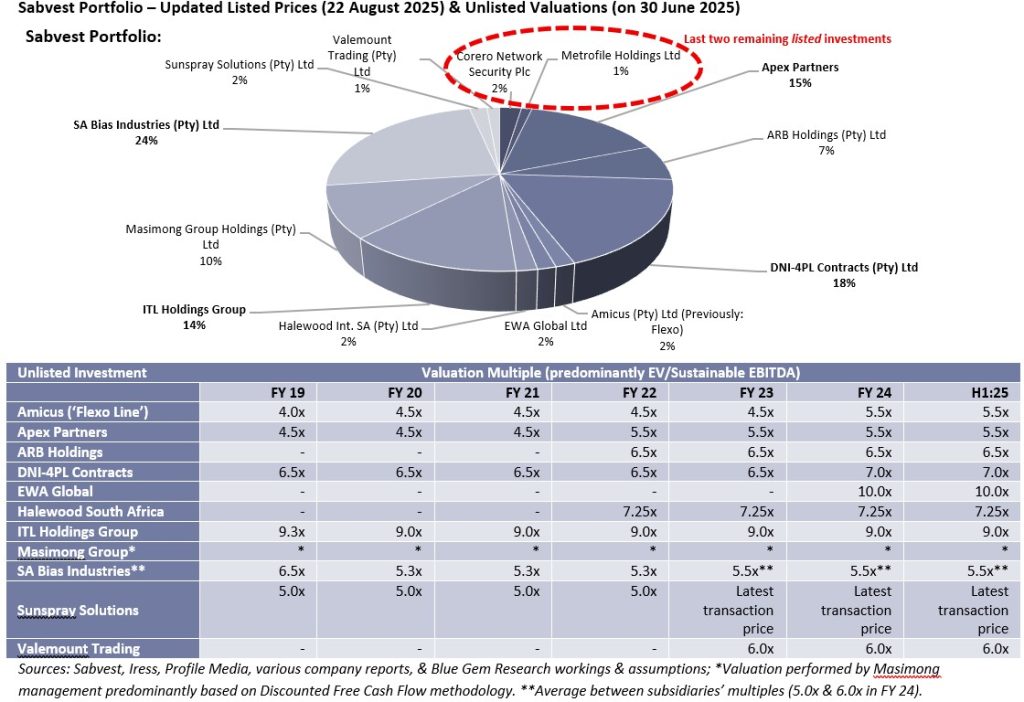

- Sabvest’s Net Asset Value (NAV) grew +15% y/y versus H1:24 (or +3% versus FY 24), which, when combined with further accretive share buy-backs, saw NAV per share grow +5% to 13882cps (FY 24: 13213cps).

- H1:25 share buybacks amounted to R69.3m (FY 24: R59.9m), or 735,000 SBP shares at a VWAP of c.9429cps (well below NAV and wonderfully accretive).

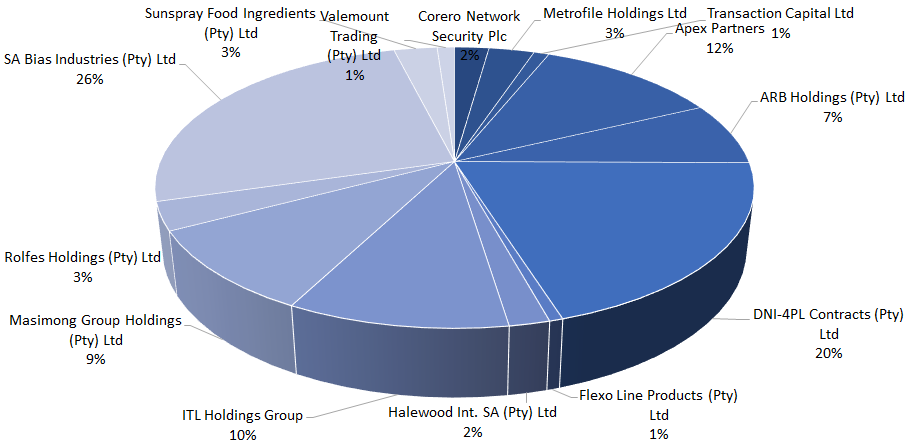

- Importantly, valuation multiples were kept flat during the period, thus providing NAV growth of good quality.

- Strong growth in Apex Partners and continued momentum in the recovery in ITL Holdings more than offset some disappointing performance in Amicus, Narrowtex (part of SA Bias), and Halewood SA.

- The dividend was hiked +14% to 40cps (H1:24 – 35cps).

Thoughts: Momentum in H2:25E could rise

- We expect continued growth from Apex (particularly as it unlocks value from DRA), and we expect ITL Holdings’ and Valemount’s respective performances to pick up momentum through the remaining year.

- We also expect near-term recoveries in both Amicus (likely) & SA Bias’ Flowmax (likely) with a medium-term upside in Valemount (probable) & Halewood (possible).

- Overall, though, we expect a good H2:25E performance from the Group’s businesses and their resulting investment values in Sabvest’s H2:25E NAV.

Valuation, 12m TP & Implied Return: Discounted

- We estimate that the share is currently trading at a c.31% discount to its current 13704cps NAV and—after including a HoldCo discount against this NAV of 10% (unchanged)—we believe that the share’s fair value is around 12334cps (previously: 11798cps).

- Rolling our post-discount fair value forward, we see the Group’s 12m TP as 14540cps (previously: 14017cps) with an implied return of +53% from these levels.